Support Our Mission to Advance Science and Strengthen the Nation's Workforce

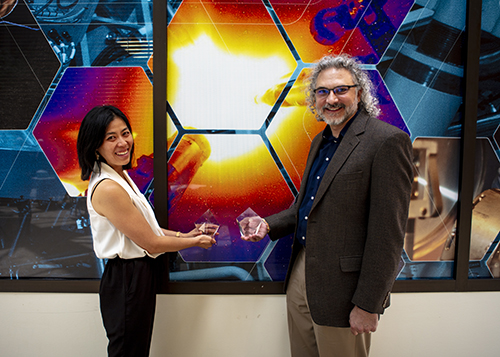

pose with their Corones Award paperweights.

Your donation directly supports our mission to recognize excellence in scientific achievement and to foster a vibrant, skilled workforce equipped to meet the nation’s scientific and technological challenges.

Through your generosity, we’re able to honor outstanding mid-career scientists with the James Corones Award in Leadership, Community and Communication and support emerging talent through the Frederick A. Howes Scholar Award. These recognitions are more than accolades — they are investments in individuals who shape the future of science.

Your gift also strengthens Krell Institute’s ongoing work to provide high-impact workforce development programs and services to national partners. These initiatives help align scientific talent with critical national needs — ensuring that early-career and established professionals alike have the tools, recognition, and opportunities they need to thrive and contribute.

Every Contribution Makes a Meaningful Impact

As the demand for a highly skilled scientific workforce grows, your support becomes even more vital.

Together, we can:

-

Recognize and inspire scientific leadership

-

Build career pathways for the next generation of researchers and innovators

-

Connect individuals and institutions to drive national progress

Donate Today

Whether it’s a one-time gift or a recurring contribution, your support helps us sustain and grow programs that matter — to individuals, to institutions and to the nation. Your donation is tax-deductible and directly fuels opportunities that advance science and serve the public good. Thank you for being part of this work.

For questions regarding gifts to the Krell Institute, contact us via web form.